News

Paris, May 25, 2022 – TotalEnergies announces the signature of agreements with Global Infrastructure Partners (GIP) to acquire 50% of Clearway Energy Group (CEG), the 5th US renewable energy player. This constitutes its largest acquisition in the renewable energy in the United States, one of the top 3 renewable markets in the world. With such transaction, TotalEnergies is further accelerating its growth in the renewable energy sector by partnering with GIP, a leading global infrastructure fund.

CEG is a developer of renewables projects and controls and owns 42 % of economic interest of its listed subsidiary, Clearway Energy Inc. (CWEN), into which projects are dropped when they reach commercial operation.

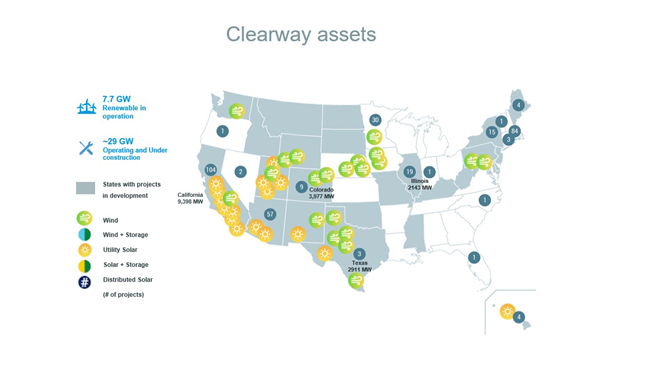

With this acquisition, TotalEnergies is establishing a major position in the U.S. renewable energy and storage market. Clearway has 7.7 GW1 of wind and solar assets in operation through its listed subsidiary CWEN and has a 25 GW pipeline of renewable and storage projects, of which 15 GW are in an advanced stage of development. Headquartered in San Francisco, Clearway has approximately 760 employees.

In the frame of this transaction, GIP will receive $1.6 billion in cash and an interest of 50% minus one share in the TotalEnergies subsidiary that holds its 50.6% ownership in SunPower Corporation (NASDAQ: SPWR), leader in residential solar in the U.S. The transaction takes into account valuations of $35.1 per share for CWEN and $18 per share for SunPower.

As part of this partnership, TotalEnergies will contribute to enhance Clearway’s growth prospects by providing CWEN in the U.S. with access to its power trading capabilities and will give it priority on the farm down of its own developed projects.

The acquisition brings TotalEnergies' renewable portfolio in the U.S. to more than 25 GW and contributes to the objective that the United States account for at least 25% of the Company's global target of 100 GW by 2030.

This transaction complements the portfolio that TotalEnergies has built up in the U.S. since the beginning of 2021:

- In large-scale solar, TotalEnergies is already developing 8 GW of projects following the acquisition of a projects portfolio from SunChase, its partnership with Hanwha Energy and the recent acquisition of Core Solar.

- In offshore wind, TotalEnergies will develop 4 GW of projects off the coast of New York and North Carolina, after having been successful in tenders.

Finally, TotalEnergies welcomes GIP as an equity partner in SunPower. SunPower is the second largest residential solar company in the U.S., providing customers with fully integrated solar, storage, home energy and financing solutions. TotalEnergies and GIP are well-positioned to support together SunPower management’s growth strategy.

“We are delighted with this partnership with Global Infrastructure Partners, which is a major player in renewables, particularly in the United States. It allows TotalEnergies to scale up in the U.S. market, one of the most dynamic in the world, benefiting from operating assets and a 25 GW high quality pipeline, in wind, solar and storage, with a wide geographic coverage with a presence in 34 states. This transaction perfectly fits with our strategy to make renewable electricity one of our main growth drivers along with liquefied natural gas that we have recently reinforced with the launch of Cameron extension. It illustrates our priority to accelerate the transformation of the company to become a sustainable and profitable multi-energy company,” said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

“We are extremely pleased to partner with TotalEnergies to continue leading the energy transition in the U.S. We are proud of the growth and accomplishments of the Clearway team since our initial investment in 2018, and we are confident that with TotalEnergies as a partner, Clearway will be able to accelerate the deployment of cost competitive renewable power in the U.S. At the same time, GIP’s investment in SunPower is our initial commitment in the distributed generation space, which we believe will provide critical solutions to facilitate the nation’s clean energy future. The scale, capabilities and ambition that both GIP and TotalEnergies bring to this partnership will support our shared vision to build industry-leading utility scale and distributed renewables platforms in the U.S.,” said Adebayo Ogunlesi, Chairman and CEO of Global Infrastructure Partners.

Both transactions are subject to customary conditions, including receipt of requisite regulatory approvals.

1 Powers are expressed in dc and correspond respectively in ac to 7 GWac in operation and 22,3 GWac in development

***

TotalEnergies and renewable electricity

As part of its ambition to get to net zero by 2050, TotalEnergies is building a portfolio of activities in renewables and electricity. At the end of 2021, TotalEnergies' gross renewable electricity generation capacity is more than 10 GW. TotalEnergies will continue to expand this business to reach 35 GW of gross production capacity from renewable sources and storage by 2025, and then 100 GW by 2030 with the objective of being among the world's top 5 producers of electricity from wind and solar energy.

About TotalEnergies

TotalEnergies is a global multi-energy company that produces and markets energies: oil and biofuels, natural gas and green gases, renewables and electricity. Our more than 100,000 employees are committed to energy that is ever more affordable, cleaner, more reliable and accessible to as many people as possible. Active in more than 130 countries, TotalEnergies puts sustainable development in all its dimensions at the heart of its projects and operations to contribute to the well-being of people.

TotalEnergies Contacts

- Media Relations: +33 (0)1 47 44 46 99 l [email protected] l @TotalEnergiesPR

- Investor Relations: +33 (0)1 47 44 46 46 l [email protected]

TotalEnergies on social media

- Twitter : @TotalEnergies

- LinkedIn : TotalEnergies

- Facebook : TotalEnergies

- Instagram : TotalEnergies

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. TotalEnergies SE has no liability for the acts or omissions of these entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).